The SBA just released updated 7(a) lending data through the end of FY 2025. For searchers and small business buyers, this is one of the clearest windows into how lenders are deploying capital, which industries are performing, and where the risks actually lie. Here's what the numbers tell us.

1. Record Year for Acquisition Lending—$8.29B YTD with 35% Growth

The acquisition financing market is on fire. Through September 2025, lenders approved $8.29 billion in SBA 7(a) acquisition loans—up 34.58% year-over-year. That's 7,003 deals funded, supporting nearly 98,000 jobs.

What's driving it? Average deal size is climbing. The typical acquisition loan now sits at $1.18 million, up 6.57% from last year. Searchers are going after larger, more established businesses—and lenders are following them there.

For context, total SBA 7(a) lending (including startups and non-acquisition uses) hit $33.4 billion in 2025, up 20.5% year-over-year. But the acquisition segment is growing faster than the broader market, signaling sustained appetite for proven, cash-flowing businesses.

2. Acquisition Loans Continue to Outperform—Default Rates 29% Lower

Here's why lenders keep writing acquisition checks: they perform better. The annual default rate for acquisition loans is 1.93%, compared to 2.71% for non-acquisition SBA loans. That's a 29% lower default rate.

The intuition makes sense: buying an existing business with customers, cash flow, and proven operations is fundamentally less risky than starting from scratch. Lenders understand this, and so should you when negotiating terms.

Historical loss rates (which factor in recovery after default) tell the same story. At 92 months from origination, the historical loss rate for the overall 7(a) portfolio is just 0.9%—meaning even when loans go bad, the SBA guarantee and collateral recovery keep actual losses low.

3. Self-Storage and Other 'Boring' Businesses Have the Best Track Records

If you're looking for industries where SBA lenders have the most confidence, follow the charge-off data.

Self-storage stands alone with a 10-year cumulative charge-off rate of just 0.02%. That's not a typo—two basis points. The annualized default rate is 0.71%, and 42% of these loans are paid off in the first five years.

Why does self-storage perform so well? It's a combination of factors: hard real estate assets provide strong collateral, the business model is relatively recession-resistant, labor costs are minimal, and cash flows are predictable with sticky monthly revenue. When things go wrong, the underlying real estate retains value—lenders can recover their principal even in a default scenario.

Other standouts share similar characteristics:

Veterinary Services — 0.97% charge-off rate, 0.67% annualized default. Recurring revenue from pet care, strong customer loyalty, and relatively inelastic demand.

Insurance Agencies — 0.86% charge-off rate, 1.77% annualized default. Recurring commissions and book value provide stable cash flows and built-in asset value.

Assisted Living Facilities — 0.36% charge-off rate, 1.50% annualized default. Real estate backing plus demographic tailwinds.

Compare these to the market average of 2.10% cumulative charge-offs and 2.54% annualized defaults. Industry selection matters.

4. Lender Metrics Vary Wildly—Choose Your Partner Thoughtfully

Not all SBA lenders are created equal, and the data proves it. Historical default rates range from under 2% at the best shops to over 6% at others.

Live Oak Banking leads the pack with a 1.93% historical default rate. Huntington National is right there at 1.90%. Meanwhile, First Internet Bank of Indiana shows a 6.28% historical default rate—more than three times higher.

What does this mean for searchers? Two things to consider:

First, lenders with lower default rates likely have tighter underwriting standards. If Live Oak or Huntington approves your deal, you've passed a higher bar. That's validation. If you're getting declined by top-tier lenders but approved elsewhere, it's worth asking why—and whether the deal structure needs work.

Second, Loss Given Default (LGD) varies dramatically by lender. Byline Bank shows a 12.14% LGD, while U.S. Bank is at 76.92%. This affects how aggressively lenders will work with you if things get tough. A lender expecting to lose 12 cents on the dollar in default has very different incentives than one expecting to lose 77 cents.

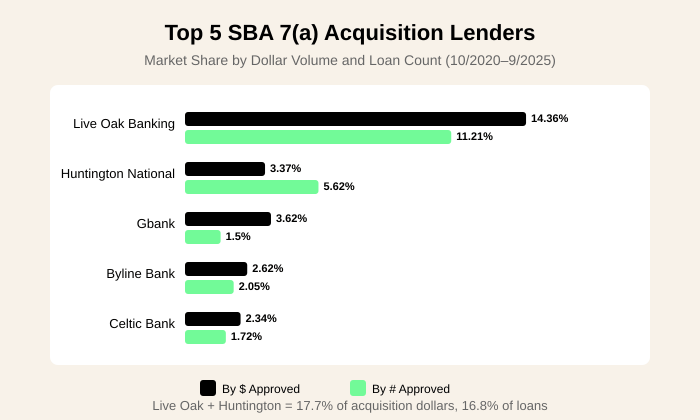

5. Live Oak and Huntington Control Nearly 1 in 5 Acquisition Loans

Market concentration is real. Live Oak Banking holds 14.36% of the acquisition market by dollar volume and 11.21% by loan count. Huntington National adds another 3.37% by dollars and 5.62% by count.

Combined, these two lenders account for 17.7% of acquisition dollars and 16.8% of acquisition loans. That's nearly one in five deals flowing through just two institutions.

Who's growing fastest with scale? Huntington is making moves. While Live Oak remains the volume leader, Huntington's loan count market share (5.62%) is nearly half of Live Oak's (11.21%) despite having far fewer total loans historically. They're clearly prioritizing this segment and closing ground quickly.

For searchers, this concentration means a few things: these lenders have deep experience in acquisition deals, they've seen hundreds of structures and situations, and they have established processes. But it also means they can be selective. Building relationships with the top players—even before you have a deal—is worth the effort.

The Bottom Line

The SBA acquisition market is healthy and growing. Default rates remain manageable, lenders are deploying capital at record levels, and the data continues to validate the thesis that buying existing businesses is less risky than starting from scratch.

If you're in the market for an acquisition, use this data to your advantage. Target industries with strong track records. Build relationships with the lenders who know this space best. And remember—the numbers are on your side.

Data source: SBA 7(a) lending data through September 30, 2025.

Join the EBIT WhatsApp community to connect with operators who've navigated this transition—and the ones preparing for it next.

Disclaimer: This guide is for educational purposes only and does not constitute legal, financial, tax, or investment advice. Business acquisitions involve significant risks, and outcomes can vary widely based on individual circumstances. Always consult with qualified professionals including attorneys, CPAs, and financial advisors before making acquisition decisions. The EBIT Community does not guarantee the accuracy of information provided or the success of any acquisition strategy. Past performance and examples do not guarantee future results.