⚡ TL;DR:

Listing analysis on 2,717 profitable businesses for sale nationwide

Florida leads with 418 deals at 3.35x avg multiple; North Carolina offers best value at 2.18x

This week: Charleston HVAC ($3.95M), Arizona electrical ($2.5M), Texas lending, Charlotte HVAC

Newly Listed Deals

HVAC & Plumbing Business

Charleston-area full-service contractor established 2006, offering heating, cooling, and plumbing services with NO construction work. Listed at 4.4x cash flow with $900K weighted average cash flow on $5.8M revenue, includes 14 vehicles, $400K FF&E, and experienced GM willing to stay for transition.

📍 Location: Charleston County, SC

💰 Asking Price: $3.95M

💼 Cash Flow: $900K

📊 Revenue: $5.8M (TTM)

🧮 Estimated DSCR: 1.56x

💵 Estimated Cash Flow After Debt Service: $323K

ℹ️ Source: Atlantic Business Brokers

⏰ Listed: 4 days ago

Business Highlights

Building/warehouse/office HQ for $7K/month NNN lease

4,900 SF building available for purchase

23 full-time employees with GM staying on

44% residential/56% commercial revenue mix

Owner financing possible for qualified buyer

Commercial Electric Company

Arizona commercial electrical contractor with 25+ years serving Greater Phoenix area, focused on underpinned projects by seasoned professionals. Listed at 3.5x cash flow with $712K cash flow on $2.6M revenue, demonstrates 45% YoY profit growth with primary focus on electrical services and CR-11 contractors license.

📍 Location: Maricopa County, AZ

💰 Asking Price: $2.5M

💼 Cash Flow: $712K

📊 Revenue: $2.6M

🧮 Estimated DSCR: 1.63x

💵 Estimated Cash Flow After Debt Service: $275K

ℹ️ Source: BusinessBrokers.Net

⏰ Listed: 3 days ago

Business Highlights

15 employees with seasoned team of professionals

45% year-over-year profit growth since 2022

25%/25% respectively commercial and residential mix

Owner financing available for qualified buyers

Growth opportunity plenty of room for expansion

POLL: When do you plan to buy a business?

Private Real Estate Lending Company

Texas-based real estate lender with 10+ years serving investors in bridge loans, Non-QM/DSCR loans, and conventional financing. Listed with $3.1M EBITDA on $5.3M revenue, only 15 foreclosures in company history, 749 average FICO score, and 25,000+ CRM contacts.

📍 Location: Texas

💰 Asking Price: Not Listed

💼 Cash Flow: $3.1M

📊 Revenue: $5.3M

ℹ️ Source: Generational Equity

⏰ Listed: 5 days ago

Business Highlights

73% average LTV with disciplined risk-based pricing

$328K average borrower assets ensuring quality clientele

6-year average team tenure with hands-on loan servicing

4.9/5.0 online reviews demonstrating customer satisfaction

Advanced tech stack with automation and real-time data sharing

Residential & Commercial HVAC Business

Charlotte-based HVAC contractor with over 20 years serving residential and commercial clients, known for same-day service and certified technicians. Revenue not disclosed, asking $1.7M, includes installation, maintenance, energy systems consulting, and 24/7 emergency response capabilities with trained technicians across multiple systems.

📍 Location: Charlotte, NC

💰 Asking Price: $1.7M

💼 Cash Flow: Not Disclosed

📊 Revenue: Not Disclosed

ℹ️ Source: BusinessBroker.net

⏰ Established: Listed 2 days ago

Business Highlights

6 employees including field technicians and admin staff

Digital diagnostics and CRM for streamlined operations

Promotional incentives like repair discounts increasing lead flow

Energy efficiency consulting and control system installation

Trusted regional provider with responsiveness focus

🛑 Stop checking multiple deal sites. We do it for you.

Every business for sale in one daily-updated spreadsheet with EBIT Pro ($39/mo):

✓ All deals from 150+ sources

✓ Compare financials instantly

✓ Filter by industry, location, price

✓ New deals highlighted daily

✓ Share with one click

🔥 DEALS HEAT MAP 2025

Where the Listing Activity is in SMB M&A

The Big Picture: 2,717 Profitable Opportunities Mapped

We fired up our listing aggregator and analyzed nearly 4,000 business-for-sale listings across 150+ listings sources to get a real-time pulse on the SMB market. This isn't about closed deals or valuations - it's about what sellers are actively bringing to market RIGHT NOW.

The data reveals unprecedented listing activity, with 2,717 profitable businesses generating $250K+ in cash flow (SDE or EBITDA) currently for sale. Here's what the numbers tell us about where opportunities are clustering:

Market Snapshot:

Total Profitable Listings: 2,717 (cash flow > $250K)

Average Cash Flow: $726K

Average Asking Price: $2.2M (3.35x multiple)

Listing Surge: July on pace for 1,200+ new listings (highest month ever)

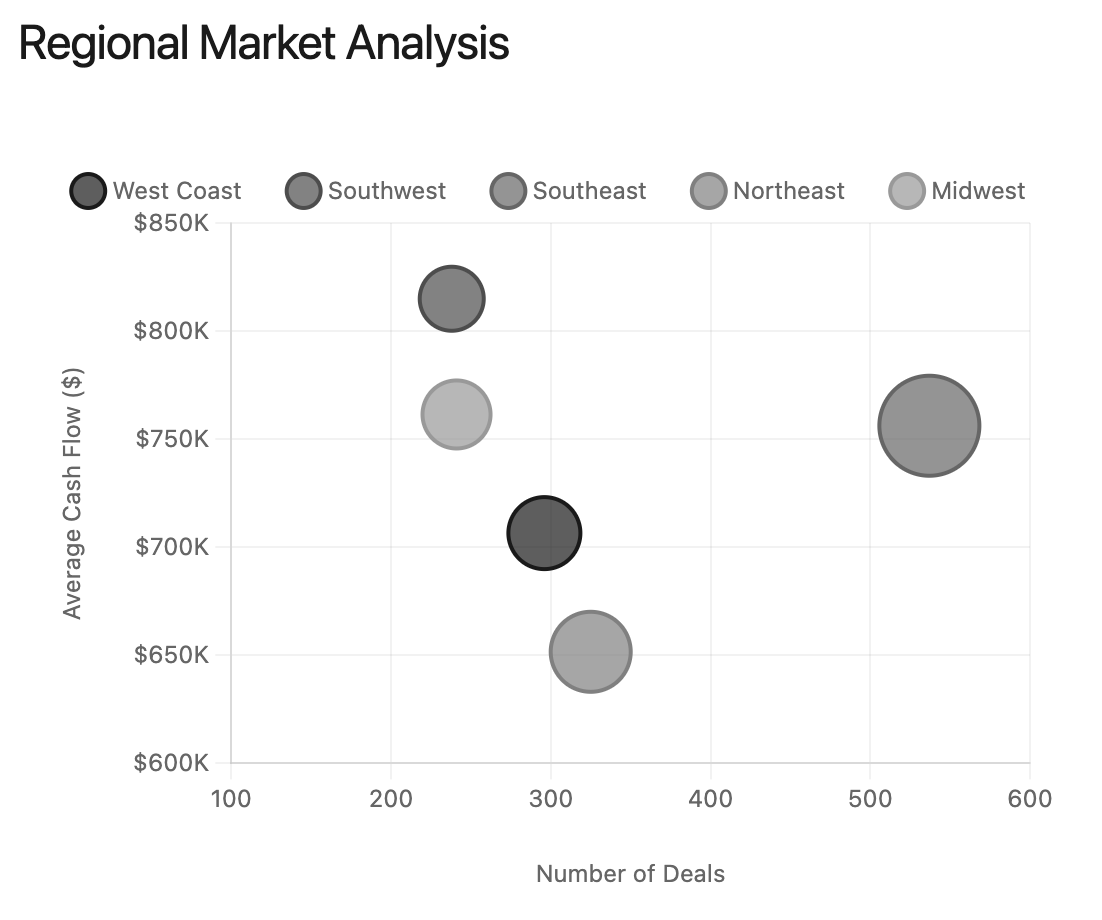

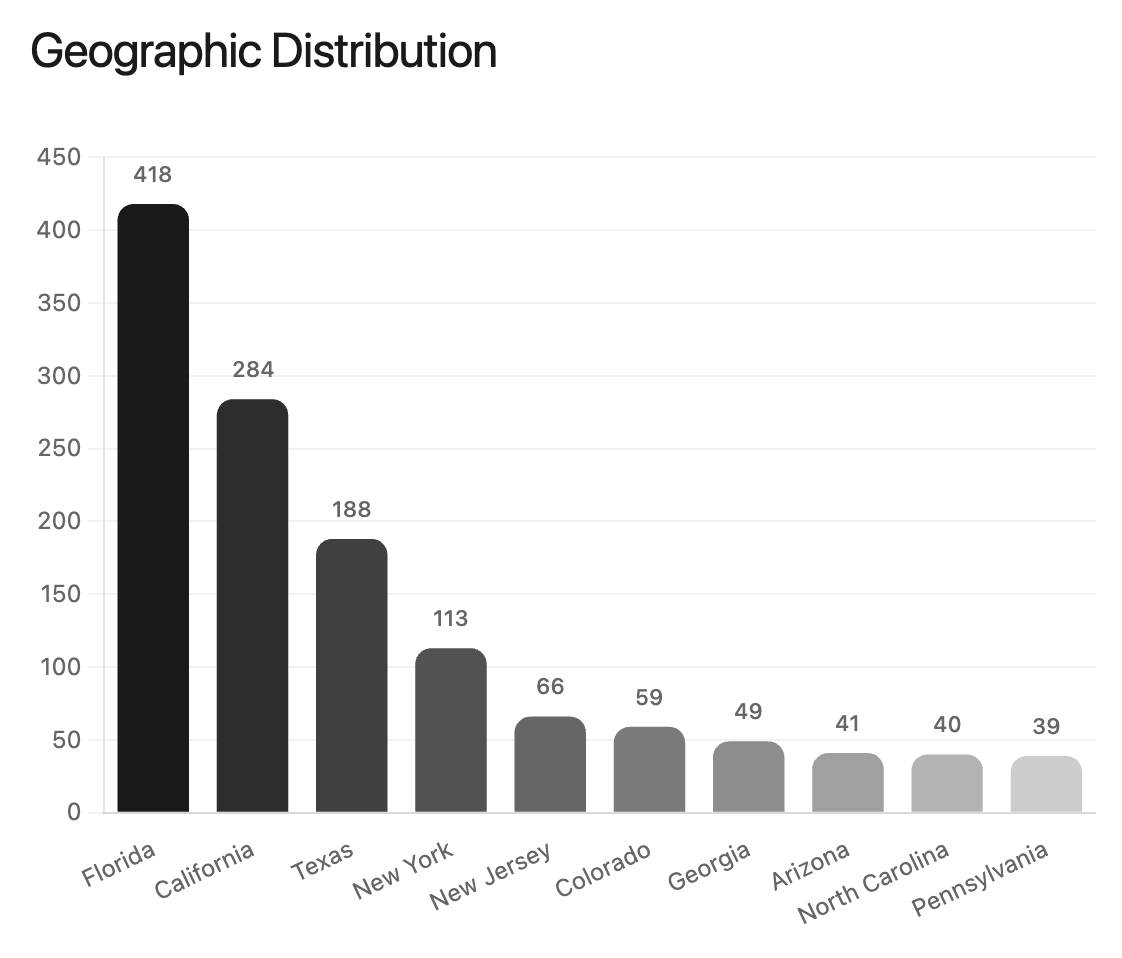

📍 Geographic Hotspots: Where Deals Are Happening

The Sunshine State Dominates

Florida leads the nation with 418 profitable deals, offering an average cash flow of $753K. The state's business-friendly environment and growing population continue to attract both sellers and buyers.

The Big Four Markets:

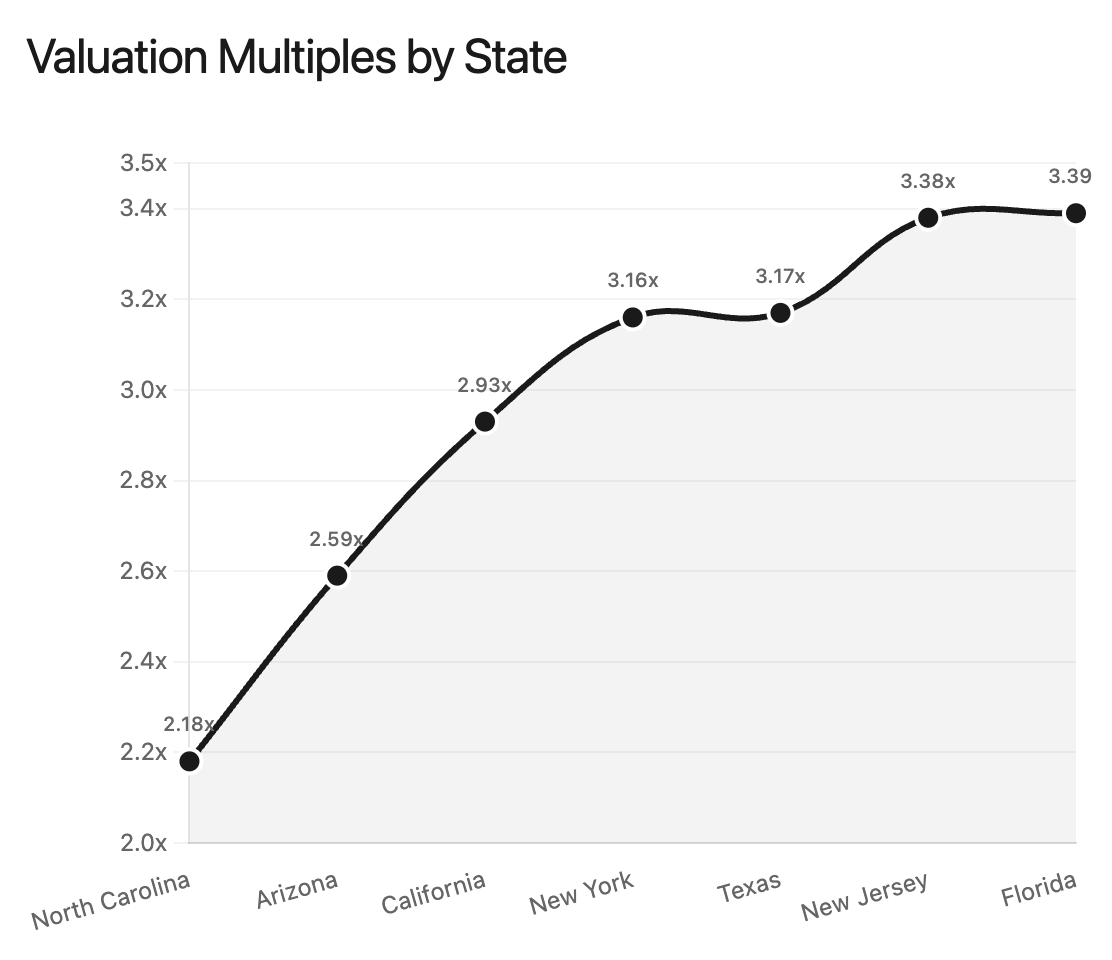

Florida - 418 deals (Avg Cash Flow: $753K, 3.61x multiple)

California - 284 deals (Avg Cash Flow: $710K, 3.24x multiple)

Texas - 188 deals (Avg Cash Flow: $783K, 3.49x multiple)

New York - 113 deals (Avg Cash Flow: $634K, 3.49x multiple)

Hidden Gems:

North Carolina offers the lowest average multiples at 2.18x

Arizona shows strong activity with 41 deals at attractive 2.59x multiples

National/Multi-location businesses command premium SDEs averaging $2.25M

🏭 Industry Insights: What's Hot and What's Not

Top Sectors by Deal Volume:

Brick & Mortar Retail - 549 deals (Traditional retail remains king)

Service Businesses - 465 deals

Medical & Healthcare - 695 deals combined (Recession-resistant)

Building & Construction - 669 deals combined (Infrastructure boom continues)

Food & Beverage - 321 deals

Surprise Finding:

Online & Technology businesses represent only 271 deals (11%) despite digital transformation trends - suggesting either higher retention rates or different exit channels for tech businesses.

💎 The "Make Me an Offer" Premium Tier

We discovered 137 deals (5.6%) with no listed asking price - and here's the kicker: these unpriced deals average $1.8M in SDE compared to just $661K for priced listings.

The Numbers Tell the Story:

Unpriced deals: $1.8M average cash flow, $9.2M average revenue

Priced deals: $661K average cash flow, $2.8M average revenue

That's nearly 3X the cash flow and revenue!

What's Going On Here?

These appear to be premium businesses where sellers are testing the market or seeking strategic buyers. The top unpriced deals include:

Mining contractor doing $19M+ cash flow on $51M revenue

Mechanical utility contractor with $16M cash flow

Food franchise network generating nearly $10M cash flow

Buyer Tip: If you're hunting for larger deals, specifically filter for listings without prices. These sellers are often more sophisticated and looking for qualified buyers who can prove capability before discussing price.

The Other Side: Incomplete Listings

We also found 1,115 listings with asking prices but no profit information - averaging $4.7M asking price on $2.7M revenue. These include asset sales, turnarounds, or strategic plays where buyers need to create the value. Different opportunity set, different risk profile.

📈 Market Momentum: Deal Flow at Record Pace

The M&A market is experiencing unprecedented acceleration in 2025:

Volume Explosion:

March: 234 listings (baseline)

April: 598 listings (+156% surge)

May: 847 listings (peak month)

June: 554 listings

July: 486 listings MTD (on track for highest month ever)

What's Driving the Surge:

Medical & Healthcare businesses have exploded from 15% to 25% of all listings since March. Whether it's regulatory changes, sector consolidation, or retirement waves, healthcare owners are rushing to exit.

The Takeaway:

With July already at 486 profitable listings mid-month, buyers have more options than ever - but competition for quality deals is intensifying. Move fast on opportunities that fit your criteria.

🎯 Actionable Insights for Buyers

Best Bang for Your Buck:

Target North Carolina for lowest multiples (2.18x average)

California tech/service businesses offer higher SDEs but reasonable multiples at 2.93x

Consider geographic premium pricing in Florida and New Jersey (3.39x and 3.38x respectively)

Sector Strategy:

Healthcare and Medical remain evergreen with 695 total listings

Construction/Building trades offer stability with infrastructure spending

Skip the hype - Food & Beverage showing standard multiples despite "experience economy" buzz

🚀 What This Means for 2025

The SMB M&A landscape shows remarkable depth with genuine opportunities across geographies and industries. While traditional sectors dominate deal flow, the relatively low multiples (3.35x average) compared to historic norms suggest we're still in a buyer's market.

The Bottom Line: With nearly 2,500 cash-flowing businesses on the market, disciplined buyers who move quickly on well-priced opportunities in secondary markets (NC, AZ, CO) may find the best risk-adjusted returns.

Data current as of July 2025. Analysis based on aggregated listing data for businesses with Annual SDE > $250K.

Ready to explore specific opportunities? Get access to all listings with EBIT Pro.

Disclaimer: Educational content only - not investment advice. Listings from third-party sources, accuracy not guaranteed. Do your own due diligence. Consult professionals before making decisions.